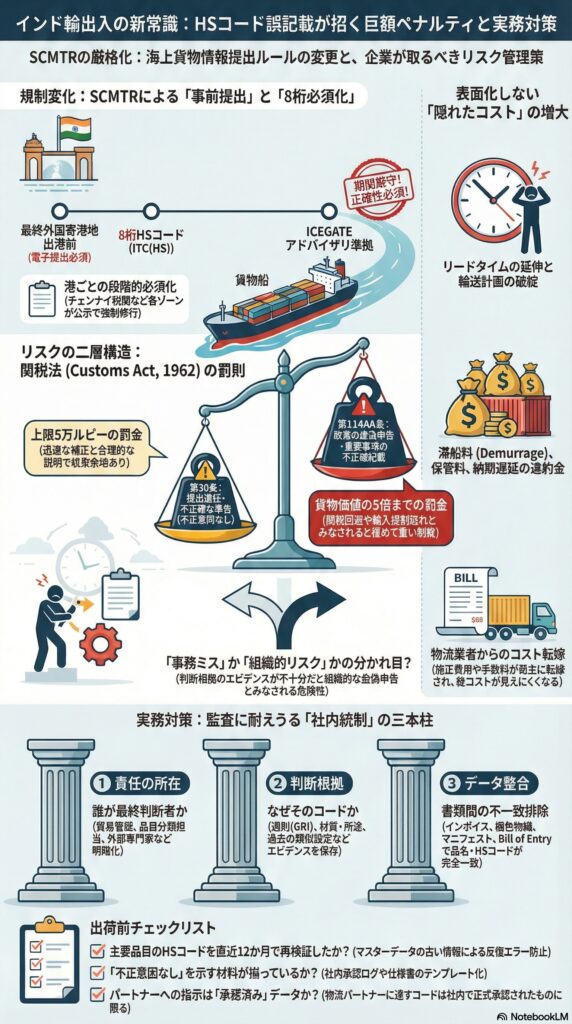

背景にあるのは、海上貨物情報の提出ルールを刷新するSCMTRの運用高度化と、それを支える関税法(Customs Act, 1962)の罰則枠組みです。

インド税関のSCMTR関連文書と関税法条文、税関ゾーンの公示(Public Notice)を確認できます(下記参照)。

・ICEGATE(インド税関EDIポータル)のSCMTR利用者向けアドバイザリにおいて、Arrival Manifest(到着マニフェスト)に8桁HSコードの記載が必須であることが明記されています。

・SCMTR(Sea Cargo Manifest and Transhipment Regulations, 2018)自体が、到着・出港マニフェストの提出タイミングを前倒しし、誤りや遅延がある場合の取扱い(修正・補完の許容条件)を規定しています。

・関税法(Customs Act, 1962)第30条は、マニフェスト提出遅延に対する罰金(上限5万ルピー)と、内容が不完全・不正確な場合の補正許容(不正意図なしの場合)を規定しています。

・同法第114AA条は、虚偽または重要事項の不正確な申告・書類利用を「故意に」行った場合、貨物価値の5倍までの罰金を規定しています。

・税関ゾーン単位では、SCMTRの新フォーマット提出を港ごとに段階的に必須化する公示が出ており、実務移行が「運用として」進んでいます(例:Chennai Customs)。

厳格化は、単に「罰金額が上がった」という話に限りません。実務上は次の2層で効いてきます。

SCMTRは、従来のIGMに代わるArrival Manifest等を、最終外国寄港地からの出港前に電子提出する運用へ寄せています。ここでHSコード(少なくとも所定桁数)が必須項目として扱われ、欠落・不整合があると、訂正対応や照会でリードタイムが伸びやすくなります。

関税法第30条は、マニフェストの提出遅延に対して上限5万ルピーの罰金を置きつつ、内容が不正確・不完全でも「不正意図なし」であれば補正を許容する枠組みを持っています。つまり、誤記載が発見されたときに「直ちに罰則」ではなく、「迅速な補正と説明で収束できる余地」が制度上は残っています。

一方で、誤ったHSコードが、関税回避や規制逃れ(輸入規制・認証対象の回避など)と結びつくと、虚偽・重要事項の不正確記載として第114AA条の射程に入り得ます(貨物価値の5倍までの罰金)。

HSコードの誤りは、単発の訂正で終わらず、マスターデータに誤りが残ると同一品番の再出荷で繰り返します。SCMTRのように事前提出が前提になると、港到着後に気づくのではなく、出港前後に差戻しが発生し、輸送計画そのものに影響します。

誤分類による追徴リスクに加え、滞船料・保管料、納期遅延の違約金、緊急輸送への切替コストが膨らみます。加えて、マニフェストの不備は物流事業者側の修正費用や手数料に転嫁されやすく、総コストが見えにくい形で増えます。

制度上、誤りの補正が許容される場合でも、説明が弱いと「なぜそのHSだったのか」「誰が判断したのか」「同種案件がないか」という論点に発展しやすい。ここで社内統制が弱いと、個別ミスが組織的リスクに格上げされます。虚偽・重要事項の不正確記載と評価されると、制裁は急に重くなります。

・誰が最終判断者か(貿易管理、品目分類担当、外部専門家)

・判断根拠(GRI、品目の機能・材質・用途、類似裁定、社内標準)

・インド固有の8桁運用(ITC(HS)相当)の扱い

この3点を最低限ひも付け、監査で再現できる状態にします。

・インボイス品名と梱包明細の品目説明

・HSコード(6桁と8桁)

・マニフェスト/申告データ(Arrival ManifestやBill of Entryに連なる情報)

書類間で品目説明とHSがずれていると、誤記載として見つかりやすくなります。SCMTRはまさにこの整合性を前提に設計されています。

・発見した時点で、補正の可否と必要資料を即判断

・不正意図がないことを示す材料(社内承認記録、仕様書、過去の一貫性)を添付

・補正の根拠として、制度上の補正許容(不正意図なし)を踏まえて説明

関税法第30条およびSCMTRには、不正意図がない不完全・不正確について補正を許容する設計が読み取れます。

SCMTRは段階的に新フォーマット必須化が進みます。例えばChennai Customsでは港ごとに必須化日程が公示されています。自社貨物が入る港とフォワーダーの運用準備がずれていると、誤記載が「訂正の遅れ」へ連鎖しやすくなります。

・主要品目のHSコードは、直近12か月で再検証したか

・HSコードと品目説明の整合を、出荷前に機械的に検知できるか

・誤記載が見つかったとき、補正と説明のテンプレートがあるか

・物流パートナーに渡すHSコードは「単なる情報」ではなく、社内承認済みのものか

・故意と見られないための記録(判断根拠・承認ログ)を保持しているか

・ICEGATE:SCMTR利用者向けアドバイザリ(Arrival Manifestに8桁HS必須の記載あり)

・Sea Cargo Manifest and Transhipment Regulations, 2018(SCMTR本体。誤り・遅延時の補正の考え方を含む)

・Customs Act, 1962(第30条:マニフェスト遅延罰と補正、第114AA条:虚偽・重要事項の不正確記載の罰則)

・Chennai Customs:SCMTRの段階的必須化に関するPublic Notice(港別の適用日程)

免責

本稿は一般的な情報提供を目的としたもので、個別案件の法的助言ではありません。実際の申告・契約・規制適合は、対象国の法令と最新の当局公表、必要に応じて専門家見解に基づき判断してください。